Re-Twin Energy presents Virtual Trading at E‑world – a new live benchmarking tool for battery storage that brings together real market performance, trading strategies and investment assumptions within a consistent, transparent evaluation framework.

Essen/Berlin, January 2026 – The assessment of battery storage projects has so far often been based on static scenarios and generic market assumptions. Especially in volatile energy markets, this approach makes it difficult to reliably compare performance, marketing strategies and revenue assumptions. This complicates the operationalisation of models and reduces the explanatory power of traditional benchmarks.

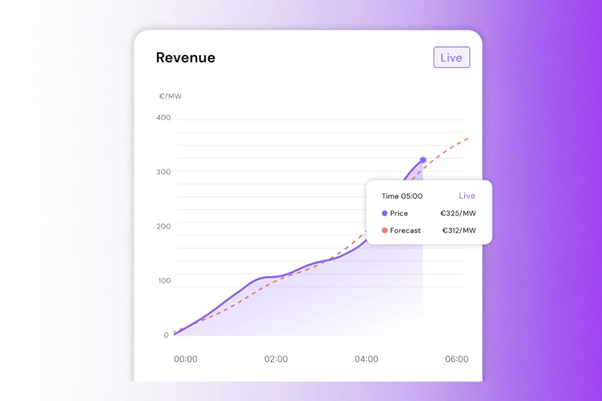

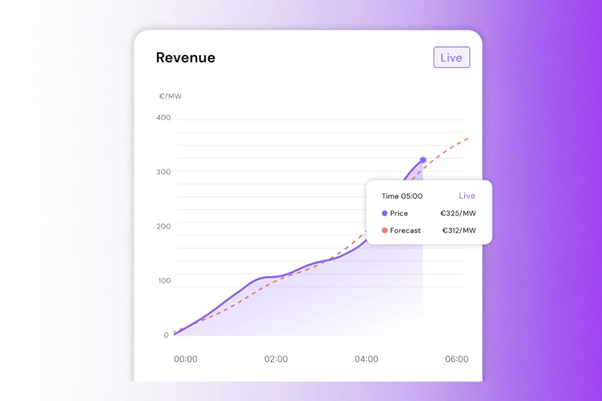

With Virtual Trading, Re-Twin Energy has launched a new product that closes this gap and, for the first time, enables daily performance assessments of energy storage systems based on real market data. The solution extends the existing platform with a live market simulation in which Re-Twin generates its own short-term forecasts, reacts to real market events and derives concrete trading and bidding strategies. On this basis, a complete bidding plan is generated and the resulting revenue performance is simulated, including key indicators such as bid success rate, utilisation and revenue structure. This creates a transparent, data-based benchmark that reflects the realistically expected performance of a storage asset, instead of relying on historical scenarios or static assumptions.

Virtual Trading automatically generates trading and bidding strategies for configured storage assets and simulates their performance in the day-ahead and intraday markets. Operators, investors and analysts can not only forecast expected revenues, but also compare the impact of different strategies and benchmark them against real market outcomes. Practical use cases include continuous performance benchmarking of individual assets, seven-day revenue forecasts, strategy comparisons and the assessment of planned assets prior to an investment decision.

The simulation results are available in the web dashboard and can be integrated into internal monitoring systems via API in order to embed them into reporting and decision-making processes. This allows not only operational control, but also investment decisions to be based on a transparent and data-driven foundation.

“Bankability is achieved when market performance and trading strategies are not only calculated theoretically, but made traceable under real market conditions,” says Dr. Mayur Andulkar, Co-Founder and Head of Product at Re-Twin Energy. “With Virtual Trading, we connect digital twins with live market data to create project-specific benchmarks that answer concrete trading and revenue questions.”

Florian Heise, Co-Founder and responsible for commercial operations at Re-Twin Energy, adds: “In daily practice, we hear from customers how important it is to validate assumptions and performance against real market developments. Virtual Trading provides a realistic approach that can be directly embedded into financing processes.”

At E‑world energy & water 2026 in Essen, Re-Twin Energy will present Virtual Trading and demonstrate how market performance, comparisons of different marketing strategies and revenue forecasts are combined in a unified, data-based evaluation. At the booth, trade visitors can learn more about how live simulations complement the benchmarking and economic assessment of BESS projects.

Hall 4, Booth 4C124

Press contact

Re-Twin Energy, Florian Heise

Tel.: +49 162 5926239 E-mail: florian.heise@re-twin.energy

About Re-Twin Energy

Re-Twin Energy is the digital analyst for battery energy storage projects. The AI-based digital twin platform economically models BESS projects and provides project developers, municipal utilities and investors with robust, project-specific business cases as a basis for financing and investment decisions. Re-Twin already counts more than 500 users; customers include companies such as Trianel, Prokon, badenova and ecostor.